virginia estimated tax payments due dates 2020

Is one of our forms outdated or broken. Virginia estimated tax payments due dates 2020 Thursday June 16 2022 Edit.

Social Security Benefits Stimulus Check In Va Marks Harrison

April 15 2020 2nd payment.

. Ad Access Tax Forms. Please enter your payment details below. All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due April 15 2020 can be made any time on or before June 1 2020 without penalty.

You can pay all of your estimated tax by April 15 2020 or in four equal amounts by the dates shown below. Why you might not want to wait to pay your estimated taxes. Under normal circumstances quarterly estimated tax payments for tax year 2020 would have come due April 15 June 15 and September 15 of this year with the final payment due on January 15 2021.

IRS has extended their filing date to July 15th. First estimated income tax payments for TY 2020. Extend the due date for certain Virginia income tax payments to June 1 2020 in response to the coronavirus disease 2019 COVID-19 crisis.

As well as any estimated income tax. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. 15 and your last payment will still be due on Jan.

June 15 2020. Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Tax Guide Online Taxes Fun Things To Do Pre Algebra 8 Curriculum Guide Freebie Pre Algebra Consumer Math Order Of Operations. Individual income tax returns and payments required to be made with such returns for Taxable Year 2020 that were originally due May 1 2021 are now due on or before May 17 2021.

Complete Edit or Print Tax Forms Instantly. Click IAT Notice to review the details. If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty.

If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make. See the Estimated Income Tax Worksheet on page 3 of Form 760ES. Businesses impacted by coronavirus can request an extension of the due date for filing and payment of their February 2020 sales tax return due March 20 2020 for 30 days.

Due dates for 2019 Virginia Estimated Tax are. It will take the state until early October to print all 17. Virginia VA Estimated Income Tax Payment Vouchers and Instructions for Individuals Form 760ES PDF.

First and Second Quarter Estimated Individual Income Tax Payment Due Dates by State as of May 19 2020 State Q1 Q2. 1546001745 At present Virginia TAX does not support International ACH Transactions IAT. Filing deadline is still May 1st but taxes due can be paid up till June 1st without penalty interest will apply.

Returns are due the 15th day of the 4th month after the close of your fiscal year. However during the extension period interest will accrue. If full payment of the amount owed during the period is not made by June 1 2020 this penalty waiver will not apply and late payment penalties will accrue.

You will still have to make your third estimated tax payment by Sept. Likewise pursuant to Notice 2020-23 the due date for your second estimated tax payment was automatically postponed from June 15 2020 to July 15 2020. Help us keep TaxFormFinder up-to-date.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You expect to owe at least 1000 in tax for 2020. However the Virginia extension to pay while penalty-free is not interest-free.

Virginia Tax is committed to keeping you informed as the Coronavirus COVID-19 crisis continues to evolve. Let us know in a single click and well fix it as soon as possible. Or fiduciary estimated Virginia income tax payments that are required to be paid during.

If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for underpayment of estimated tax computed on Form 760C. In most cases you must pay estimated tax for 2020 if both of the following apply. Ad Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now.

If the due date falls on Saturday Sunday or legal holiday you may file your voucher on. Please refer to Publication 505 Tax Withholding and Estimated Tax PDF for additional information. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020.

What is Virginia Tax Deadline 2021. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Individual Income Tax Filing Due Dates.

54 rows In Some States 2020 Estimated Tax Payments Are Due Before 2019 Taxes Are Due. As a result no penalties will apply so long as a return is filed and full payment is made by May 17 2021. 2018 Form 760ES.

Virginia Tax is announcing that any income tax payments due during the period from April 1 2020 to June 1 2020 can now be submitted at any time on or before June 1. 2020 Form 760ES Estimated Income Tax Payment Vouchers for Individuals. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number.

January 10 2022 Beer and Wine Tax. Make the estimated tax payment that would normally be due on January 15 2021. Typically most people must file their tax return by May 1.

The combined payments -- 325 for individuals or 650 for married couples filing jointly -- will be included in one paper check.

Tax Calculator Estimate Your Taxes And Refund For Free

Virginia Retirement System Pension Info Taxes Financial Health

Virginia Self Employment Tax Calculator 2020 2021

Tax Calculator Estimate Your Taxes And Refund For Free

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money Cnet

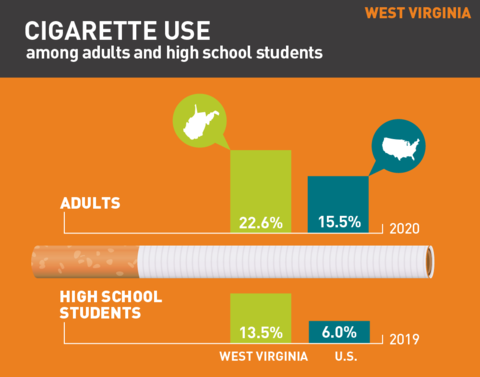

Tobacco Use In West Virginia 2021

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash-050214-credit-vs-debit-cards-which-better-v2-02f37e6f74944e5689f9aa7c1468b62b.jpg)

Credit Cards Vs Debit Cards What S The Difference

Va Disability Payment Schedule For 2021 Cck Law

Disposable Plastic Bag Tax Begins In 5 Virginia Localities Starting January 1 2022 Virginia Tax

2022 Va Disability Pay Chart And Compensation Rates Cost Of Living Adjustment Cck Law

6 Tips To Get A Head Start On Your 2020 Tax Return Forbes Advisor

/april-5th-tax-accounting-year-end-174616068-99b39924d6ae472b97f8ae3e3db5565b.jpg)